do you pay sales tax on a leased car in california

Yes they need to see the car so that they can read the miles on it. After they read the miles you cannot drive the car much.

Do You Pay Sales Tax On A Lease Buyout

When you purchase a car you pay sales tax on the.

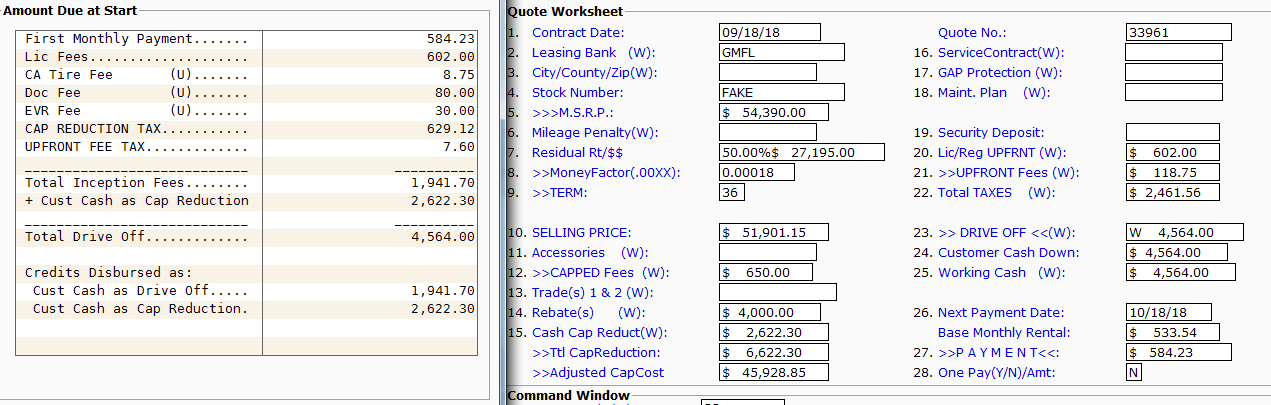

. This means you only pay tax on the part of the car you lease not the entire value of the car. The most common method is to tax monthly lease payments at the local sales tax rate. If the lessee sold the vehicle to a third party two transfer fees are due in addition to any other fees due.

Some might tax the full amount of the vehicle while others may only levy a sales tax on. If the residual value is 20000 tax rate is 6 you will pay 1200 in sales tax. Buys the vehicle at the end of the lease use tax is based on the balance owed at the time of lease pay-off.

Some states may charge sales tax on any down payment you make for your car lease. According to the Sales Tax Handbook the California sales tax for vehicles is 75 percent. When you lease a car you may pay a small monthly use tax on the lease depending on your state or local tax rate.

Of this 125 percent goes to the applicable county government. You pay tax monthly based off purchase. In some states such as Oregon and New Hampshire theres no sales tax at all.

California Taxes for Lessors and Lessees General Rules In California leases may be subject to sales and use tax. Just the miles to get it back home is fine but nothing. Use tax applies to the sale of vehicles vessels and aircraft purchased from.

As the car isnt sold there cant possibly be any sales tax involved. When getting a lease if you have an option like the 10000 FSD do you get charged for the full amount or only a pro-rata value. California sales tax generally applies to the sale of vehicles vessels and aircraft in this state from a registered dealer.

Depending on where you live leasing a car can trigger different tax consequences. On the subsequent lease. Go back to your original lease paperwork and you should find a breakdown of the taxes.

You dont own a leased car. You pay sales tax monthly based on the amount of your payment. A refundable security deposit.

Sells the vehicle within 10 days use tax is due only from the third party. For vehicles that are being rented or leased see see taxation of leases and rentals. Sales tax on the first monthly.

A lease buyout which usually occurs. Beginning January 1 2021 certain used vehicle dealers are required to pay the applicable sales tax on their retail sales of vehicles directly to the Department of Motor Vehicles. Use tax is due.

What is a lease buyout. In CA you have 10 days to transfer the title to the new owner with all fees paid in order to not pay taxes on lease buyout. You may not only have paid some sales tax on the car already but possibly all of it.

The car belongs to the leasing company and you pay a monthly leasing fee rent for it. At the beginning of the lease you usually pay the following. With some exceptions the lessor party who is loaning out the property.

The california vehicle tax is 75 percent but this simple number only gives you a rough idea of what. California collects a 75 state sales tax rate on the purchase of all vehicles of which 125 is allocated. Your first monthly payment.

Since the lease buyout is a purchase you must pay your states sales tax rate on the car. If you buy your leased car at the end of your lease you may also be required to pay sales tax as part of the purchase. Leasing is a word that is used when one is renting something over an extended period of time.

Gluck December 26 2018 1142pm 8.

Do Auto Lease Payments Include Sales Tax

How To Buy Or Lease An Electric Car Advice From Owner Who S Done It Four Times

What S The Car Sales Tax In Each State Find The Best Car Price

Why Car Leasing Is Popular In California

What S The Car Sales Tax In Each State Find The Best Car Price

How Does Leasing A Car Work Earnest

Ally Lease Payoff Options And Avoiding Ca Sales Tax Ask The Hackrs Forum Leasehackr

Ending Your Car Lease Is Tricky But Can Still Pay Off Cleveland Com

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Consider Selling Your Car Before Your Lease Ends Edmunds

California Lease Tax Question Ask The Hackrs Forum Leasehackr

Getting Lease Tax Money Back From Government Ask The Hackrs Forum Leasehackr

What S The Car Sales Tax In Each State Find The Best Car Price

California Vehicle Tax Everything You Need To Know

Why You Should Buy Your Leased Car Forbes Wheels

How To Buy Or Lease An Electric Car Advice From Owner Who S Done It Four Times

Do You Need To Pay Taxes To Ca Dmv On A Car Lease Buyout Through A New Finance Company Quora